Business Loan EMI Calculator

In order to determine how much EMI you will end up paying on availing a Business Loan, the first step is to ascertain the loan amount that you should avail so that the EMI is affordable and does not impact with your monthly business needs. You can estimate your EMI by using the SME Loan EMI Calculator given above.

How does the Business Loan EMI Calculator Work?

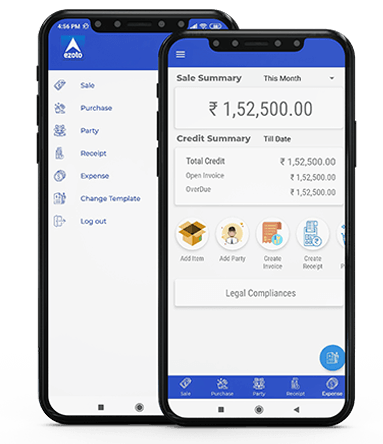

EZO business loan EMI calculator calculates the monthly instalments/ EMI you have to pay, thus helping you to plan your repayment in future.

Please enter the below details on the EMI calculator:

- Principal (loan amount)

- Tenor

- Rate of interest

The calculator uses the following formula:

E = P x r x (1 + r) ^ n / [(1 + r) ^ n - 1]

Where,

- E is the EMI.

- P is the principal or loan amount

- r is the rate of interest (calculated monthly)

- n is the tenor (calculated monthly)

Check the following example to see how the calculator works:

You have a business loan of Rs. 25 Lakh at 18% rate of interest for 4 years. As per the above formula, your EMI will be:

E = 25,00,000 x 18%/18 x (1 + 18%/18) ^ 4 / [(1 + 18%/18) ^ 4 – 1]

E = 73,437

Hence, your EMIs will be Rs. 73,437.

What is a Business Loan EMI?

EMI or Equated Monthly Installment refers to the monthly repayments you make to the loan issuer. An EMI usually consists of two parts: the principal amount borrowed and the accrued interest. The accrued interest is calculated on the interest rate that is quoted at the time of loan disbursal.

Benefits of using a Business Loan EMI Calculator

- Save yourself from Tedious Calculations

- Visualization Benefits

- Useful for Financial Planning

- Time Saving

- Accurate Results

- Allows to evaluate multiple schedules

Factors affecting Business loan EMI

- Loan amount – The amount you need to borrow for business expansion or purpose. Higher the loan amount, higher will be the EMI.

- Rate of interest – The interest rate on a loan is an important determinant of the EMI. Higher the interest rate, higher will be the EMI and vice-versa.

- Loan Tenure – Longer the loan tenure, lower the EMI. Longest loan tenure for business loans in India is 5 years.

People also Considered

Business Loan EMI Calculator FAQs

What if I miss EMI payment or there is an ECS bounce?

What if I get delayed in paying the business loan EMI?

How do I check my eligibility for a business loan?

Why is it necessary to calculate EMI beforehand?

Does the loan tenure affect my EMI for business loan?

How EZO Business Loan EMI calculator helps in calculating EMI?

Is the business loan EMI fixed or can it change in future?

1.Banks generally offer a floating rate of interest on business loans if interest rates increase but banks typically keep the EMI constant and increase the loan tenure. So, you will pay the same EMI but for a longer duration. However, if your loan tenure is maximum (as per permissible limit) then your bank may increase the EMI amount.

2. For partly disbursed loans availed under tranched EMI scheme, your loan EMI will increase with each disbursement.

3. You can prepay your loan or you can opt to reduce your EMI and keep the loan tenure the same or keep the EMI unchanged and reduce the loan tenure. It is more beneficial to keep the EMI same and reduce the loan tenure.

4. However, you may opt to reduce the EMI in case you so desire.Any other situations as per terms and conditions of the loan agreement.

Knowledge Center

Knowledge Center